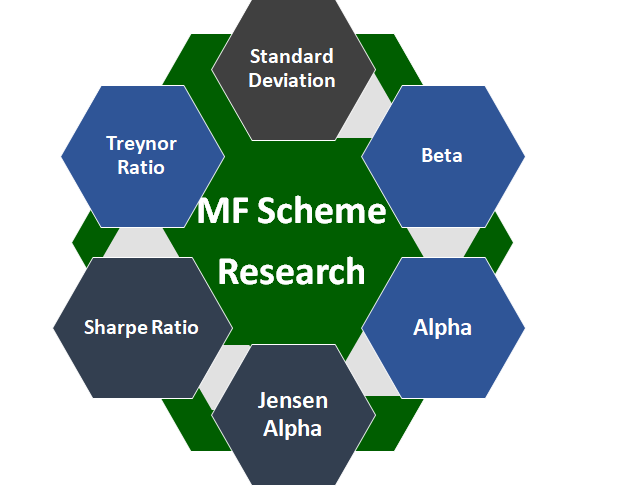

SD - Standard deviation

measures the dispersion of a set of data points from their mean. In

finance, it represents the volatility of an asset's returns over a

specific period, indicating the degree of variation or risk associated

with the asset. Higher SD implies higher volatility and higher risk.

Beta - Beta is a measure of an

asset's volatility in relation to the overall market. A beta greater

than 1 indicates that the asset is more volatile than the market,

while a beta less than 1 means it is less volatile.

Alpha - Alpha represents the

excess return of an investment relative to the return of a benchmark

index. It measures an asset's performance on a risk-adjusted basis,

indicating the value added by an investment manager's decisions.

Higher alpha implies good portfolio performance with respect to

benchmark.

Jensen's Alpha - Jensen's

Alpha calculates the abnormal return generated by a portfolio over the

expected return predicted by the Capital Asset Pricing Model (CAPM).

It is used to determine the effectiveness of a fund manager in

generating returns above the market-adjusted expectation. Higher

Jensen's Alpha implies good portfolio performance with respect to

benchmark.

Sharpe Ratio - The Sharpe

Ratio measures the risk-adjusted return of an investment. It is

calculated by subtracting the risk-free rate from the asset's return

and dividing the result by the standard deviation of the asset's

returns, indicating how well the return compensates for the risk

taken. A Positive Sharpe Ratio implies positive risk-adjusted return

of an investment whereas a Negative Sharpe Ratio implies the reverse.

Treynor Ratio - The Treynor

Ratio, similar to the Sharpe Ratio, measures the risk-adjusted return

of an investment, but it uses beta as the risk measure instead of

standard deviation. This ratio indicates how much excess return was

generated per unit of market risk. A Positive Treynor Ratio implies

positive excess return of an investment generated per unit of market

risk whereas a Negative Treynor Ratio implies the reverse.

Sortino Ratio - The Sortino

Ratio is a variation of the Sharpe Ratio that differentiates harmful

volatility from overall volatility by using downside deviation instead

of standard deviation. It measures the risk-adjusted return of an

investment, focusing on downside risk only. A Positive Sortino Ratio

implies positive risk-adjusted return of an investment focussing on

downside risk.